All Categories

Featured

Table of Contents

- – What are the tax implications of an Annuity Wi...

- – How do Annuity Payout Options provide guarante...

- – How can an Annuities For Retirement Planning ...

- – How does an Annuity Payout Options help with ...

- – Why is an Annuities For Retirement Planning ...

- – What are the tax implications of an Fixed-te...

Keep in mind, however, that this does not state anything concerning changing for inflation. On the plus side, also if you assume your alternative would certainly be to purchase the stock market for those seven years, which you 'd obtain a 10 percent yearly return (which is far from certain, especially in the coming decade), this $8208 a year would certainly be more than 4 percent of the resulting small stock value.

Example of a single-premium deferred annuity (with a 25-year deferment), with 4 repayment options. Courtesy Charles Schwab. The month-to-month payout below is highest for the "joint-life-only" alternative, at $1258 (164 percent greater than with the instant annuity). Nonetheless, the "joint-life-with-cash-refund" alternative pays out only $7/month much less, and guarantees a minimum of $100,000 will be paid.

The means you buy the annuity will determine the solution to that concern. If you get an annuity with pre-tax bucks, your costs decreases your taxed income for that year. According to , acquiring an annuity inside a Roth plan results in tax-free settlements.

What are the tax implications of an Annuity Withdrawal Options?

The consultant's primary step was to establish a comprehensive monetary strategy for you, and after that describe (a) just how the suggested annuity fits into your total strategy, (b) what alternatives s/he taken into consideration, and (c) just how such options would or would certainly not have actually caused lower or greater payment for the consultant, and (d) why the annuity is the premium choice for you. - Fixed vs variable annuities

Certainly, an expert might try pushing annuities even if they're not the very best fit for your circumstance and goals. The reason could be as benign as it is the only item they sell, so they drop target to the proverbial, "If all you have in your tool kit is a hammer, pretty quickly everything starts resembling a nail." While the expert in this situation may not be dishonest, it boosts the risk that an annuity is an inadequate option for you.

How do Annuity Payout Options provide guaranteed income?

Since annuities usually pay the representative selling them a lot higher compensations than what s/he would certainly receive for spending your money in common funds - Annuity withdrawal options, allow alone the absolutely no payments s/he would certainly obtain if you purchase no-load shared funds, there is a huge incentive for agents to push annuities, and the extra complex the better ()

A deceitful advisor recommends rolling that quantity into new "much better" funds that simply happen to lug a 4 percent sales tons. Consent to this, and the advisor pockets $20,000 of your $500,000, and the funds aren't likely to perform far better (unless you picked much more inadequately to begin with). In the same example, the expert could steer you to buy a challenging annuity with that said $500,000, one that pays him or her an 8 percent compensation.

The advisor attempts to rush your choice, declaring the offer will certainly quickly go away. It might without a doubt, however there will likely be comparable offers later on. The advisor hasn't found out just how annuity repayments will certainly be strained. The consultant hasn't disclosed his/her compensation and/or the fees you'll be billed and/or hasn't revealed you the impact of those on your ultimate payments, and/or the payment and/or fees are unacceptably high.

Current interest prices, and thus projected settlements, are historically reduced. Also if an annuity is appropriate for you, do your due persistance in comparing annuities marketed by brokers vs. no-load ones offered by the issuing business.

How can an Annuities For Retirement Planning protect my retirement?

The stream of month-to-month repayments from Social Security is comparable to those of a postponed annuity. Because annuities are volunteer, the people buying them normally self-select as having a longer-than-average life expectations.

Social Protection advantages are completely indexed to the CPI, while annuities either have no inflation security or at most supply a set percent annual increase that might or might not make up for inflation completely. This type of biker, just like anything else that boosts the insurance provider's risk, requires you to pay even more for the annuity, or accept reduced repayments.

How does an Annuity Payout Options help with retirement planning?

Disclaimer: This short article is intended for educational functions just, and should not be considered economic advice. You must speak with a monetary professional before making any kind of major monetary choices.

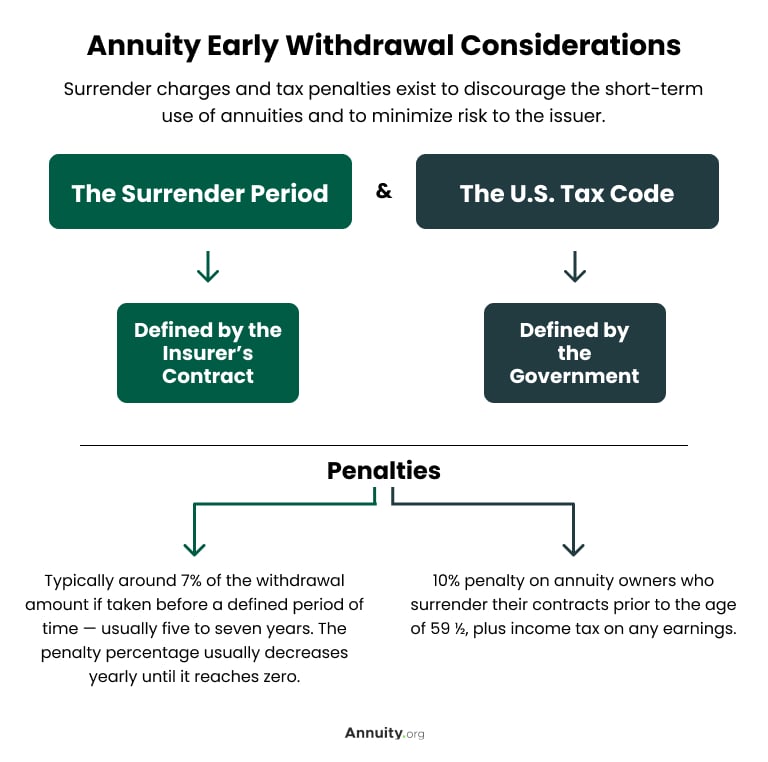

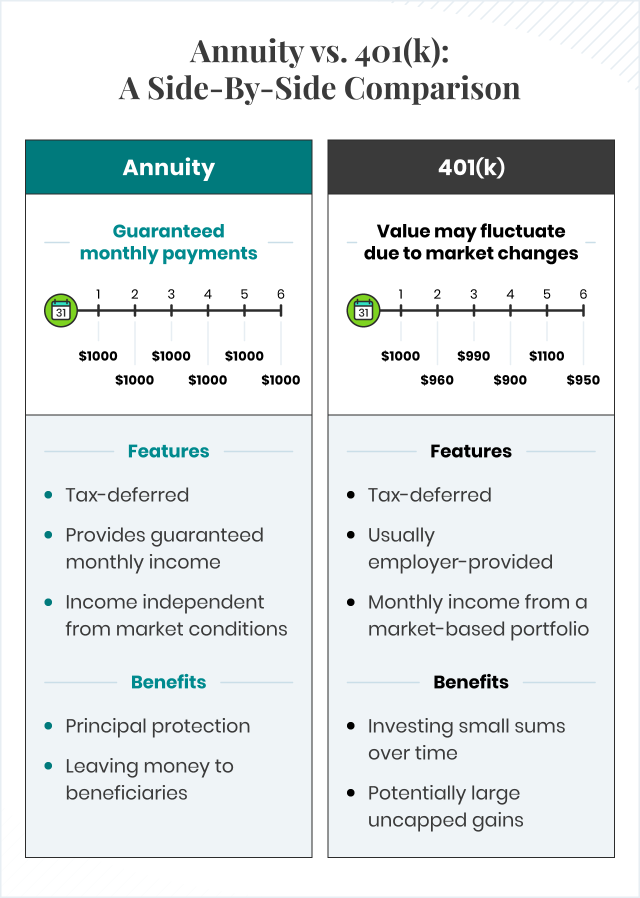

Because annuities are meant for retirement, taxes and penalties may apply. Principal Security of Fixed Annuities. Never lose principal because of market performance as fixed annuities are not bought the market. Also throughout market downturns, your cash will certainly not be impacted and you will not lose cash. Diverse Investment Options.

Immediate annuities. Deferred annuities: For those who desire to expand their cash over time, however are willing to defer access to the money till retirement years.

Why is an Annuities For Retirement Planning important for long-term income?

Variable annuities: Provides higher potential for growth by investing your money in investment choices you select and the capability to rebalance your profile based on your preferences and in such a way that aligns with altering financial goals. With dealt with annuities, the business invests the funds and offers a rates of interest to the client.

:max_bytes(150000):strip_icc()/present-value-annuity.asp-Final-7d2ae860c2b044069d77d5e626c5a6f3-72cf6d2c9f9041608b7cd343cbc3f2f4.png)

When a death claim occurs with an annuity, it is necessary to have actually a named beneficiary in the agreement. Different options exist for annuity death advantages, depending upon the contract and insurance company. Choosing a reimbursement or "period certain" choice in your annuity gives a survivor benefit if you die early.

What are the tax implications of an Fixed-term Annuities?

Calling a beneficiary aside from the estate can assist this procedure go much more smoothly, and can aid guarantee that the proceeds go to whoever the individual desired the cash to head to as opposed to undergoing probate. When present, a death benefit is immediately consisted of with your contract. Depending on the kind of annuity you buy, you may be able to include improved death benefits and features, however there could be added prices or fees related to these attachments.

Table of Contents

- – What are the tax implications of an Annuity Wi...

- – How do Annuity Payout Options provide guarante...

- – How can an Annuities For Retirement Planning ...

- – How does an Annuity Payout Options help with ...

- – Why is an Annuities For Retirement Planning ...

- – What are the tax implications of an Fixed-te...

Latest Posts

Exploring Fixed Annuity Or Variable Annuity Key Insights on Fixed Annuity Or Variable Annuity Breaking Down the Basics of Fixed Vs Variable Annuity Pros And Cons Benefits of Choosing the Right Financi

Analyzing Strategic Retirement Planning Everything You Need to Know About Financial Strategies Breaking Down the Basics of Fixed Interest Annuity Vs Variable Investment Annuity Pros and Cons of Fixed

Breaking Down Your Investment Choices Everything You Need to Know About Annuities Variable Vs Fixed What Is Fixed Vs Variable Annuity? Advantages and Disadvantages of Different Retirement Plans Why Ch

More

Latest Posts